XM Trading was founded in 2009, and its business vision is to become a leader in its field. The head office of the company is located in Cyprus and another headquarter is located in Belize. In general, the company succeeded in attracting thousands of traders of different nationalities to trade with it by providing distinguished services, the most important of which is the minimum deposit of $ 5, in addition to offering a bonus without a deposit of $ 30.

On the other hand, there are some drawbacks to the company’s business, the most important of which is the high spread compared to other companies and the lack of service for trading in digital currencies such as Bitcoin, Ripple, and Ethereum. In this article, we will review the various aspects of XM’s business and software and highlight its strengths and weaknesses.

XM Credibility – Is XM Trusted?

The credibility of trading companies can be judged by the licenses they obtained to conduct their business in a legal environment. These licenses mean that the company is subject to oversight and supervision by international financial bodies, which provides protection for clients’ funds.

In the case of XM, we find that the company has obtained several licenses from reputable financial institutions, including:

- CySEC: Cyprus Securities and Exchange Commission

- ASIC: Australian Financial Markets Regulatory Commission, License Number (443670)

- FCA: UK Financial Conduct Authority, License No. (705428)

Such licenses are very important to the money of the traders, as such institutions impose strict rules on the trading companies, such as compensation programs of up to 50,000 euros in cases of default and bankruptcy of the company.

By obtaining such licenses, the company is bound by other standards such as:

- Keeping the traders’ funds in accounts separate from the company’s funds with trusted banks, so that the company cannot in any way use those funds in its operations

- The company is committed to providing a secure medium for withdrawing and depositing funds, so that they are protected from theft

- The company is committed to encrypting its website with the latest technology so that it is not possible to steal personal data of customers

The financial assets that XM provides for traders to invest in

XM distinguishes itself by the number of financial assets it provides to traders to invest in, which are more than 1200. The company seeks through this great diversity to meet the different needs and desires of traders so that it becomes possible to diversify the investment portfolio with the largest number of financial assets.

The financial assets that XM provides to traders to invest in can be divided into a number of groups as follows:

- Forex : XM provides traders with the possibility to invest in 57 major and minor currency pairs, the most famous of which are “Euro-dollar, GBP-dollar and dollar-yen”.

- Stocks : XM provides the possibility to speculate on more than 1,200 shares using the CFD method

- Global Indices: XM allows trading of 30 global indices, the most famous of which are Dow Jones and Standard & Poor’s

- Precious metals: There is the possibility of trading in a number of precious metals, the most famous of which are gold and silver. Read in detail about gold trading and the factors affecting its prices .

- Energy sources: A number of the most popular energy sources can be traded such as oil and natural gas

It is taken from XM that it does not provide the possibility of trading in digital currencies in any way, knowing that large numbers of investors have a strong desire to trade in these currencies, as it is considered a distinct investment opportunity from their point of view, due to its rapid movements that can be taken advantage of and enter In short term deals and make good profits.

XM offers its traders leverage on Forex currency pairs up to 1:888.

Withdrawal and Deposit at XM

XM Deposit Methods

Funds can be deposited with XM in several ways, the most important of which are (various credit cards, electronic banks such as PayPal, and wire transfers). XM is characterized by providing a very low limit and it may be the lowest at all “this minimum is 5 USD”, but it should be noted that the forex market has a lot of fluctuations that make the idea of investing a small amount useless idea.

Deposits are made instantly and without any problems, with the exception of bank transfers that take up to 3 days for third-party considerations.

Withdrawing profits from XM

Profits are withdrawn in the same way that the funds were deposited, for security considerations and to protect clients’ funds in the event that the client’s account and data are stolen. The profit withdrawal process takes place in a short time and most of the time does not exceed 24 hours.

Commissions and fees charged by XM

XM offers three types of trading accounts (Standard, Micro, and Ziro). The commission received by XM varies according to the type of account. In Standard and Micro accounts, the company does not get any currency other than the spread, while in the Zero accounts, XM charges a commission in addition to the spread. The commissions received by XM Trading Company can be detailed as follows:

- Spread: In the Zero account, the average spread on the EUR/USD pair is 0.1 pips, which is a very low spread, but it should be noted that XM charges $7 as commission on each traded contract, while in Standard and Micro accounts, the average spread for the same pair is 1.7 pips. .

- Overnight commission: XM charges a commission on deals that remain open for a number of nights. This commission varies from one currency pair to another, and the method of calculating it is by finding the difference between the interest rate of both currencies involved in the currency pair.

The overnight commission is prohibited according to the provisions of Islamic Sharia: Learn about this in detail in our article: The ruling on trading in Forex.

Notes:

- XM’s spread is variable, it increases in hours of low liquidity, as at night, and in times of major political and economic news that is expected to cause violent shocks in the markets. Therefore, the trader should be very careful, especially those who trade with small amounts of money and with high leverage, as the high value of the spread in the circumstances we mentioned previously may be enough to spur the trading account.

- Overnight commission is prohibited according to the provisions of Islamic Sharia, but it should also be noted that XM offers an Islamic Forex account to which the overnight commission is not applied.

- The spread that XM gets is not competitive compared to other companies that charge lower commissions.

XM Trading Platforms

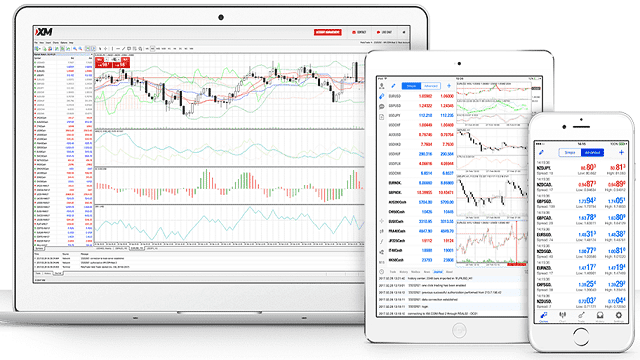

XM provides traders with two types of trading platforms, MetaTrader 4 and MetaTrader 5. These platforms are the most popular in the forex market and provide traders with a number of advantages such as a simple user-friendly interface, various forms of charts, and technical indicators, in addition to a market news service and a calendar Economic.

Note: The MT4 and MT4 platforms can be downloaded as an application for computers for all operating systems and can be worked on through the web directly without the need to download the application.

XM Mobile Trading

As in the case of computers, XM provides the possibility of trading through mobile devices using the MetaTrader 4 and MetaTrader 5 platforms. These platforms can be downloaded for Android and IOS and start trading without any problems.

Through the trading platforms available for smartphones, the trading account can be fully managed, and it has all the advantages that are available to those platforms available for computers.

XM Trading Client Services

It can be said that XM’s customer services are rather good due to a number of reasons that can be explained below:

- The website is available in more than 30 languages and technical support services are available in a number of languages to deal with the largest possible number of customer requests.

- Technical support is available 5 days a week and 24 hours a day, which is the working hours of the forex market . These services are also provided in several ways, such as live chat, phone call and email communication.

- XM provides educational services for beginners including daily reports and market research. The company also has a program called Tradepedia through which it offers educational content to experts and novices alike in a number of ways including video clips.

- The company provides a social trading platform, and allows novice traders to copy the trades of experts, although this service is weak compared to a number of companies such as Zulutrade.

- The company provides technical analysis and trading signals service that is automatically generated, in addition to daily illustrated analyzes that take the form of a television interview.

Is XM a scam?

The question about trading companies and their credibility is one of the most common questions among traders, especially when it comes to money, which is one of the most sensitive issues for people of all kinds.

In the case of XM, and after we reviewed most of its business, it became clear to us that the company has a reliable business record of close to 10 years, in addition to obtaining several licenses to conduct its business from international financial institutions.

Of course, the company’s business may suit some traders and may not suit others, but this does not mean in any way that accusations be directed against it if it does not conform to our desires and needs, or if the shortcomings are the result of our actions.

XM . Bonus

XM offers its traders a set of bonuses, including a $30 no deposit bonus for everyone who opens a trading account with it ( note: the bonus without deposit is not available to traders from Egypt and Palestine ). On the other hand, the company offers a bonus that sometimes reaches 100% on deposits. The company also offers a range of other promotions such as contests with cash prizes for real and demo accounts.

How to get the XM Bonus?

Those who wish to trade with XM can get a bonus of $30 without the need for a deposit, after submitting all the required documents and activating the account. The trader has the right to claim the bonus within a period of 30 days after activating the account and is not entitled to claim it after the expiry of this period.

A trader with XM can withdraw the profits of the “no deposit bonus”, but he cannot withdraw the bonus itself, and the investor also needs to trade 5 regular contracts “5 lots” in order to be able to withdraw the bonus profits.

Conclusion

XM is one of the good companies in the forex industry, it has a set of strengths, as well as weaknesses, and in order to get to know XM closely, you can open a demo account with it and learn about all the services they provide.

In the following table, we explain the most important advantages and disadvantages of XM company:

| XM Advantages | XM Disadvantages |

| It has strong licenses from several international financial institutions | The commissions they take are not competitive compared to others |

| Allows you to trade more than 1200 different financial assets | Cryptocurrency trading is not provided |

| Provides customer and website services in more than 30 languages | Social trading service is not competitive compared to others |

| Offers incentives and promotions including a $30 no deposit bonus | The spread changes during the day and this may put small accounts at risk of strong volatility |

| Withdrawal and deposit is instant and without any problems and the minimum deposit is 5 dollars | They do not have their own trading platforms |